Self-employed and want to buy a house?

We can get you started on the path toward home ownership whether you’re self-employed or just thinking about making the transition. As long as you can prove a steady income, and a low debt-to-income-ratio, home-ownership is possible.

As a self-employed borrower you may need extra time to gather the information you need so it is good to connect with a lender early — before you start house shopping. Lenders will be relying heavily on your previous 2-3 years of taxes to show a consistent income, and the more evidence of income stability you can provide, the better.

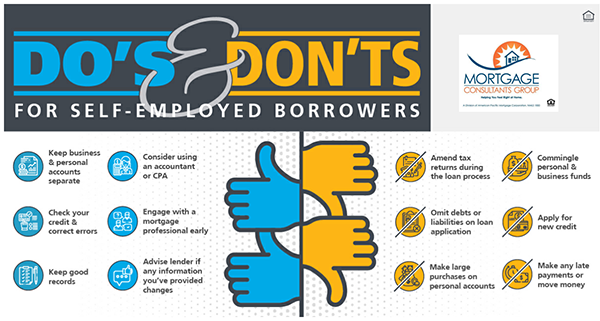

- Keep good records with business and personal accounts separate

- You will want to be extra careful about the expenses you write off

- Consider using an accountant or CPA to help you with reporting

No matter what type of borrower you are, hold off on making large purchases on your personal accounts or applying for new credit before and during the home loan process. This article on what you need to know as a self-employed borrower is a great place to start.

DTI: Debt-To-Income Ratio – what you need to know

A high DTI may send a signal that your debt load is unmanageable – which makes you a bigger credit risk. Before you start submitting loan applications, you need to review your credit report and how much debt you pay each month compared to your monthly income. There is no absolute standard for a good or bad ratio, but the lower your DTI the better. If your DTI is 50% or higher, your options may be limited. This blog from Experian gives some great information on calculating your DTI.

Jim Langdon has been in the home loan consulting business for over 25 years. Let his experience guide you through the home loan process. Check out his 5-Star google reviews!

Jim Langdon, NMLS #228920

Mortgage Consultant

Licensed in California by the Dept. of Business Oversight under the CRMLA.