Mortgage Checkup – Is it the right time to refinance?

Interest rates have fallen to an all-time low recently. How do you know if it is the right time for you to refinance? The answer is different for everyone, so you should take the time to look at some numbers before re-structuring your loan.

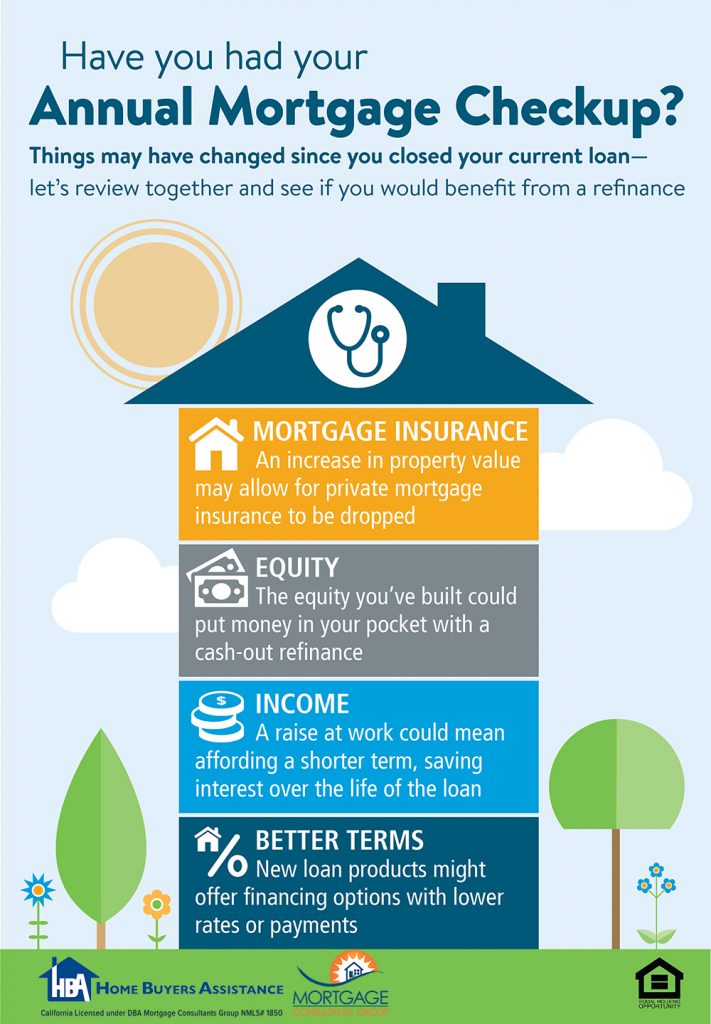

Factors to consider before refinancing:

When did you last refinance? An increase in property value may allow for private mortgage insurance to be dropped.

Loan terms: Can you reduce the time it will take you to pay off your mortgage? New loan products might offer financing options with lower rates or payments. Depending on what you owe, it might be possible to reduce the term, or number of months, on your loan. The options to explore might be a 15 or 20 year term vs. a traditional 30 year mortgage.

What are the costs of refinancing, and how long will it take to re-coup those costs? Be sure to review the loan cost estimate provided so you understand what funds need to be paid out of pocket or the amount that will be added on to your loan amount. This is where an apples to apples comparison is extremely important and will vary based on the lender you are working with.

Refinance CalculatorWill you be moving in the next 1-3 years? Often it is not cost-effective to refinance if you expect to be selling your home in the next 1-3 years. Using the calculator above allows you to determine how much time it will take to “make up” the money it cost you to refinance. Typically, the more you save on monthly interest, the faster you can realize the savings.

Contact Mortgage Consultant Jim Langdon to discuss any of your questions and learn about the options you have to refinance your mortgage.

NMLS #228920

[forminator_form id=”2243″]