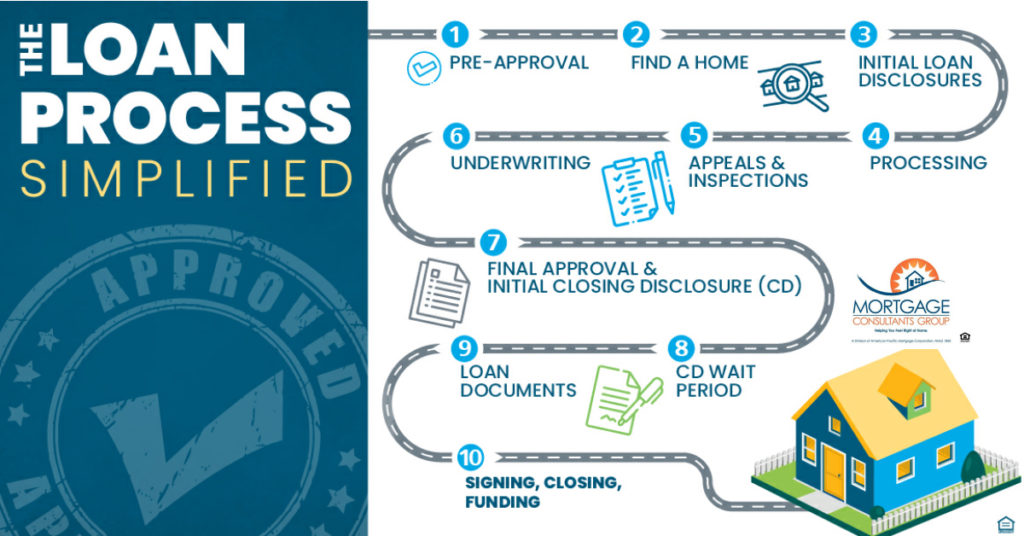

The Home Loan Process

The steps on your path to home ownership.

We are here to help you through the Home Loan Process so there are no delays getting your home purchase finalized.

Loan Appointment – Meet with Jim Langdon and ask a million questions. He will have the answer or find one for you! There are NO silly questions!

You found a home! You and the Seller have both signed the Purchase Contract. Time to move forward with the Formal Loan Approval Process!

Processing – Tracy Yoder is the Mortgage Consultants Group customer service specialist. She will take care of processing your loan to get it ready for formal approval. She has been in the business for 20 yrs and we all love working with her. She may call you from time to time, if she needs anything for your file.

Appraisal and Inspections -The property appraisal and all the inspections usually are completed within about 14 days. You will receive copies of these reports. Most transactions will have an appraisal, pest inspections and home inspection. Ask your real estate agent about the pest and the home inspection. Jim will order the appraisal and mail a copy to you.

Loan approval – After the appraisal is completed, it will be sent to the lender with all your other documentation. The formal loan approval will follow in about 5 business days. Now is the time to choose a Home Owner’s Insurance policy. Please call the Title Company to give them this information.

Give notice – If you are renting a home give notice to your landlord. Start packing! Plan to arrange your new Utilities, Phone, Cable, etc … (See the Important Phone Numbers sent to you by Jim Langdon).

Approval conditions returned to underwriter – The formal loan approval will have some additional conditions needed by the lender to fund the loan. These are items that must be received by them ASAP. The sooner they get these last items, the sooner you will be signing your final loan documents at the title company.

Loan Documents Printed – Once the lender has issued a formal approval and they have received all the conditions that they requested to fund the loan, they will print your final loan documents and send them to the title company for you to sign. Jim will call you to go over your final closing figures to make sure that there are no surprises.

Loan Documents Signed – You will sign your final papers at the title company who is handling the escrow to this transaction.Loan Funding – Once the buyer and seller signs the final loan documents, they go back to the lender to review. After reviewing everything, the lender will issue a funding checklist to the title company, lender and agents. This is where any loose end is completed. ( example: missed signatures, missing copies of paperwork, etc … ) Every one works together to gather any missing piece to coordinate a smooth funding.

Loan Documents Signed – You will sign your final papers at the title company who is handling the escrow to this transaction.Loan Funding – Once the buyer and seller signs the final loan documents, they go back to the lender to review. After reviewing everything, the lender will issue a funding checklist to the title company, lender and agents. This is where any loose end is completed. ( example: missed signatures, missing copies of paperwork, etc … ) Every one works together to gather any missing piece to coordinate a smooth funding.

Deed Recorded – Usually the next day after the loan funds, your Trust Deed will be recorded at the county recorders office. When it is confirmed that the deed has recorded, you are considered the official owner of the property! Congratulations, you get the keys to your new home!

Deed Recorded – Usually the next day after the loan funds, your Trust Deed will be recorded at the county recorders office. When it is confirmed that the deed has recorded, you are considered the official owner of the property! Congratulations, you get the keys to your new home!

We have helped 1000’s of people. Now it is YOUR TURN!