Contact a Home Loan Advisor

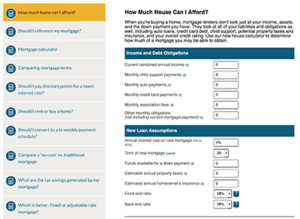

How much house can you afford?

Sounds silly, but the first step to buying your home is not house shopping! The pre-approval process is crucial because you don’t want to lose a chance at your dream home because you were not eligible for a mortgage in the amount you needed.

Our trained advisors can help walk you through the pre-approval process – before you fall in love with your dream home. Once you are pre-approved, you will know how much home you can afford and have a pre-approval letter ready for when you make that offer on your new home. You can read more about first time buyer borrower eligibility here.

Start your pre-approval with this simple form, or call 918-717-5626.

Buying a home is one of the largest purchases you will make in your lifetime. We will handle your documents with professionalism and respect for your privacy. Jim Langdon has been helping families buy homes since 1993, and he can help you too. The pre-approval process doesn’t cost you anything, so why not get started today?

[forminator_form id=”2245″]

Pre-qualified vs. Pre-Approval – what is the difference?

Getting pre-qualified usually is a quick process with minimal information submitted online. To obtain a pre-approval letter the process takes a little longer, and when you have that letter in-hand, you can start house shopping with confidence that you will be approved for the amount that was pre-approved.

In this video Jim explains the difference between being pre-qualified for a loan vs. having a pre-approval letter in-hand.

2200 Sunrise Blvd, Suite 168, Gold River, CA 95670

CAL BRE: #01215943 / #001192990

NMLS #228920 / #1850