Home Buying Explained for the First Time Home Owner

We are here to help and answer your questions.

There are many first time home buyer loan programs available and the home loan process can be a maze of paperwork. Our program is free, you just takes one phone call to get the answers to your questions.

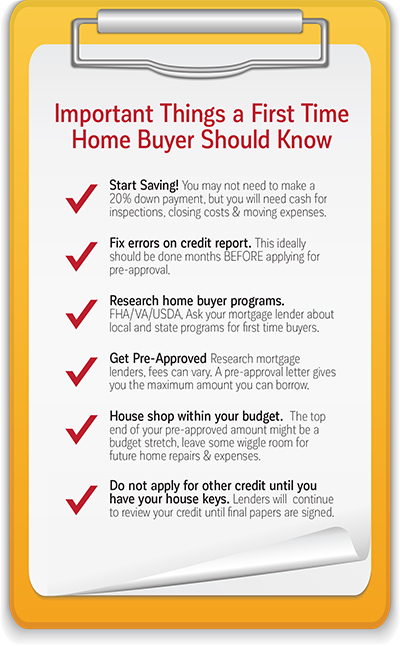

Steps to buying a house: Important things first time buyers should know.

Research first time home buyer programs. There are first time home loans that require as little as 3% down, and a few that require zero down. The plethora of information can be overwhelming, so our job is to help you understand which loan program fits your needs.

You might be surprised that a local lender has the flexibility your won’t find working with a bank or online-only lender. FHA, VA, USDA as well as state programs are examined in relation to your circumstances. We recommend you get a quote from three lenders and really compare the details. If you obtain these quotes within 45 days, this will not affect your credit record. Buying your first home is one of the largest purchases you will make – this is an important time to look past the hype and ask lots of questions.

Obtain a pre-approval letter. This step is important for a number of reasons:

— You will know your maximum budget (you don’t have to use the max amount for which you are approved)

— You will be ready to make a serious offer

— Less hassle because lender has most of the information they need

— Be aware that pre-approval and pre-qualification are NOT the same

Did you know?

- A mortgage can keep your monthly living expenses consistent – something you don’t get when you rent

- It is possible to qualify for a home loan when you still have student loan debt

- Programs are available to those with less than perfect credit

- Begin the home buying process with a pre-approval letter so you make a competitive offer

It only takes one day to get pre-approved.

You won’t know if you qualify until you try, contact a professional today and get your pre-approval started. There is no fee involved, so you have nothing to lose.

- Make a loan appointment to get ALL your questions answered and paperwork processing – if you would like to meet in-person just let us know.

- Don’t hesitate to ask more questions here – review all the expenses involved for inspections, closing costs and, of course, the moving van!

- We are here to help you every step of the way…from Loan Approval until the final papers are signed with Title Company.

- You can see an overview of the home buying process here.

Items needed to complete your pre-approval:

Identification

- Driver’s license or U.S. passport

- Social Security card or number

- A copy of the front and back of your permanent resident card (if you aren’t a U.S. citizen)

- Credit history (lender will pull a credit report)

Employment verification

- Income

- Pay stubs covering the last 30 days

- W-2 forms from the last two years

- Proof of any additional income

- Federal income tax returns (personal and business) with all pages and schedules from the last two years

Assets

- Bank statements proving you have enough money to cover the down payment and closing costs

- A gift letter saying your down payment is a gift, not an IOU (if applicable)

- Latest quarterly statements for asset accounts including your 401(k), IRA, stock accounts and mutual funds

Resources for First Time Home Buyers

What you should know before hiring a real estate agent.

Video: Learn more about buying your first home.

First time home buyer tips to help your loan process go as smoothly as possible.

American Society of Home Inspectors: Homeowner Resources

Mortgage Consultants Group is A Division of American Pacific Mortgage Corporation NMLS #1850. You can read our privacy policy here.

[forminator_form id=”2243″]